Raise closed, search for fresh raises on Seedstage

Dacula, GA

Funding residential real estate development in tourism-driven markets to support investor income and property sales.

- Defined short and long-term strategy: Initial projects support near-term income while future expansion targets sustained growth.

- Target market advantage: Located in high-demand Smoky Mountain region with strong tourism and limited housing supply.

- Hands-on execution model: Projects designed, developed, and managed directly by the fund for quality control.

- Investor income structure: Promissory notes with targeted annual returns and clear distribution plan.

- Experienced leadership: Team with over 25 years of real estate investment and development experience.

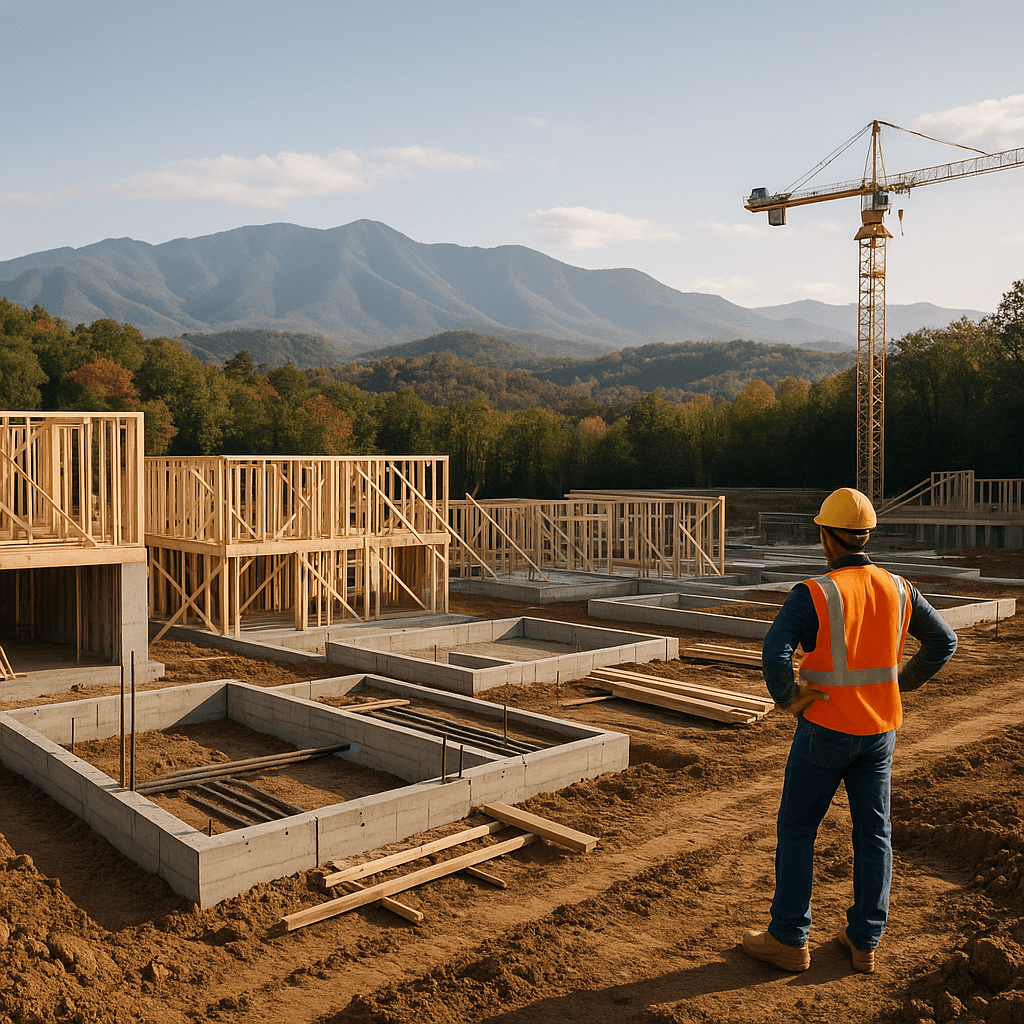

Elevation Real Estate Fund is conducting a fundraising campaign to support the development of residential real estate projects in Gatlinburg and Pigeon Forge, Tennessee. The initiative centers around the construction of luxury townhomes strategically located in high-demand, tourism-driven areas. By focusing on modern design, premium finishes, and professional management, the fund aims to meet the growing demand from second-home buyers and vacation rental investors in a market characterized by limited new construction due to geographical constraints. The raised capital will be used to acquire land, finalize plans, secure permits, and build high-margin developments while providing investors with fixed-income returns through promissory notes.

The company has already secured sites for its initial two projects and developed a phased timeline for construction, pre-sales, and investor distributions. Elevation Real Estate Fund employs a hands-on approach to project execution, working with vetted vendors and contractors to maintain quality and efficiency. The fund’s investment model is centered on consistent tourism traffic to the Smoky Mountains region and an undersupplied housing market, creating an opportunity for strong rental demand and resale potential. Funds raised will enable the company to execute its short-term goal of completing two townhome developments and its long-term plan of expanding into additional residential assets.

Company Info

Elevation Real Estate Fund offers 12% annual returns through promissory notes funding premium townhome developments in Tennessee’s high-growth Smoky Mountain market.

Elevation Real Estate Fund is a debt-focused investment fund dedicated to developing high-quality residential real estate in Gatlinburg and Pigeon Forge, Tennessee. The fund raises capital through a $5 million offering of three-year promissory notes with a targeted annual return of 12%, payable quarterly. Its initial projects include two premium townhome developments, strategically located near major attractions like Dollywood and Great Smoky Mountains National Park. These properties are designed to meet demand from vacation renters, second-home buyers, and real estate investors seeking high-quality, move-in-ready homes.

With 12.2 million annual visitors and limited available land, the region presents a strong case for both rental income and property appreciation. The fund employs a comprehensive vetting process, experienced development team, and strict construction timelines to ensure predictable project delivery and investor returns. Additional long-term plans include expanding into luxury custom homes and select fix-and-flip opportunities, with conservative financial modeling and multiple exit strategies in place.